downloadvideobokep.site

Learn

Cost Of Cash Out Refinance

See current cash-out refinance mortgage rates using NerdWallet's cash-out refi rate tool. A cash-out refinance replaces your current mortgage with a loan. The cash out refinance process is very similar to a traditional closing process, meaning that you will have to pay closing costs on your refinance. Common cash. Cash-out refinance costs. You'll typically spend between 2% and 6% of your loan amount on refinance closing costs with a cash-out refinance. The fees on a cash. Lenders typically subtract these costs from the additional cash you're borrowing. Closing costs are usually 2% to 5% of the loan amount, or $2, to $5, for. Cash-out refinancing gives you a lump sum of money tied to your home mortgage. · A cash-out refinance may come with a lower interest rate but higher repayment. Instead, it's a rate-and-term refinance, meaning the borrower refinanced to get a better interest rate or loan term, or to work with a different lender. Today's competitive refinance rates ; year fixed · % ; year fixed · % ; 5y/6m ARM · %. As discussed earlier, homeowners typically spend anywhere from 2% to 5% of the total loan amount on closing costs. The exact expenses you'll need to cover to. These costs can include appraisal fees, attorney fees, and taxes and are usually % of the loan. Do I have to pay taxes on a Cash-Out Refinance? A Cash-Out. See current cash-out refinance mortgage rates using NerdWallet's cash-out refi rate tool. A cash-out refinance replaces your current mortgage with a loan. The cash out refinance process is very similar to a traditional closing process, meaning that you will have to pay closing costs on your refinance. Common cash. Cash-out refinance costs. You'll typically spend between 2% and 6% of your loan amount on refinance closing costs with a cash-out refinance. The fees on a cash. Lenders typically subtract these costs from the additional cash you're borrowing. Closing costs are usually 2% to 5% of the loan amount, or $2, to $5, for. Cash-out refinancing gives you a lump sum of money tied to your home mortgage. · A cash-out refinance may come with a lower interest rate but higher repayment. Instead, it's a rate-and-term refinance, meaning the borrower refinanced to get a better interest rate or loan term, or to work with a different lender. Today's competitive refinance rates ; year fixed · % ; year fixed · % ; 5y/6m ARM · %. As discussed earlier, homeowners typically spend anywhere from 2% to 5% of the total loan amount on closing costs. The exact expenses you'll need to cover to. These costs can include appraisal fees, attorney fees, and taxes and are usually % of the loan. Do I have to pay taxes on a Cash-Out Refinance? A Cash-Out.

Compare cash out mortgage refinance rates from top mortgage lenders, tailored to you. Get actual prequalified rates in minutes. One of the largest expenses you'll pay if you decide to move forward with a cash-out refinance is closing costs. Just like you did with your current mortgage, a. Learn about your refinancing options. · Traditional refinance · Cash-out refinance · Existing client credit offer. VA Cash-out Refinance Loan · % · %APR · Features. Refinance up to 90% of the value of your home. ; VA Interest Rate Reduction Refinance Loan (IRRRL). Closing costs for a cash out refinance can average between 2% and 6% of the loan amount according to Forbes. Sometimes you can add these costs to your loan. However, many homeowners with FHA mortgages will choose to refinance to a conventional mortgage to eliminate the cost of the mortgage insurance required with. Cash-out refinancing replaces your current mortgage with a new one for a higher loan amount that includes both the original loan balance and an additional. The loan proceeds are first used to pay off your existing mortgage(s), including closing costs and any prepaid items (for example real estate taxes or. For first-time users of the VA loan benefit, the VA Funding Fee on a Cash-Out refinance is %. For those reusing their benefit, the VA Funding Fee on a Cash-. One of the largest expenses you'll pay if you decide to move forward with a cash-out refinance is closing costs. Just like you did with your current mortgage, a. Yes. Closing costs for a cash-out refinance loan are usually about % of your newly established mortgage. So for a $, property, the estimated. Here are today's cash-out refinance rates in. Take the next step by getting a personalized quote in as quick as 3 minutes with no impact to your credit score. A cash-out refinance replaces an existing mortgage with a new loan with a higher balance, sometimes with more favorable terms than the current loan. Cash out refinancing occurs when a loan is taken out on property already owned in an amount above the cost of transaction, payoff of existing liens. A cash out refinance, like any other refinance, will come with a host of fees and closing costs to consider. Make sure the numbers add up in your favor before. Unlock your financing options with a cash-out refinance. A personalized rate quote takes just a few minutes and won't affect your credit score. Delayed Financing Exception; Student Loan Cash-Out Refinances; Loan-Level Price Adjustments. Eligibility Requirements. The following requirements apply to cash. Whatever you need it for, a cash-out refinance lets you use your home's equity to cover these costs at a lower rate than many other loans and credit cards. Closing costs tend to vary between lenders. But you can still get a good idea on what fees are standard when it comes to closing costs. The Annual Percentage Rate is %. No prepayment penalty. Payment shown does not include taxes and insurance. The actual payment amount will be greater.

What Is The Best Reverse Mortgage

The link below takes you to the FHA-approved lender search for all FHA lenders. To find reverse mortgage lenders only, you must. Considering a reverse mortgage loan? Already have one? Learn more about Home Equity Conversion Mortgages (HECMs), the most common type of reverse mortgage. Equitable's reverse mortgage is a simple way to turn a portion of your hard-earned home equity into tax-free cash— with no monthly payments required. The only reverse mortgage insured by the U.S. Federal Government is called a Home Equity Conversion Mortgage (HECM), and is only available through an FHA-. A home equity loan taps into your home's value and overall equity. It provides you with a large lump sum upfront that you repay over a specific payment cycle. The HECM is the FHA's reverse mortgage program that enables you to withdraw a portion of your home's equity to use for home maintenance, repairs, or general. The CHIP Reverse Mortgage for Canadians 55 and over. Access up to 55% of your home value in tax-free cash! Keep the home you love; No monthly mortgage payments. Type of reverse mortgage: There are three types of reverse mortgages: single-purpose, proprietary (also known as private), and Home Equity Conversion Mortgages. Fairway Reverse Mortgage, a division of Fairway Independent Mortgage Corporation, proudly offers HECM, Reverse for Purchase, and Jumbo reverse mortgages. The link below takes you to the FHA-approved lender search for all FHA lenders. To find reverse mortgage lenders only, you must. Considering a reverse mortgage loan? Already have one? Learn more about Home Equity Conversion Mortgages (HECMs), the most common type of reverse mortgage. Equitable's reverse mortgage is a simple way to turn a portion of your hard-earned home equity into tax-free cash— with no monthly payments required. The only reverse mortgage insured by the U.S. Federal Government is called a Home Equity Conversion Mortgage (HECM), and is only available through an FHA-. A home equity loan taps into your home's value and overall equity. It provides you with a large lump sum upfront that you repay over a specific payment cycle. The HECM is the FHA's reverse mortgage program that enables you to withdraw a portion of your home's equity to use for home maintenance, repairs, or general. The CHIP Reverse Mortgage for Canadians 55 and over. Access up to 55% of your home value in tax-free cash! Keep the home you love; No monthly mortgage payments. Type of reverse mortgage: There are three types of reverse mortgages: single-purpose, proprietary (also known as private), and Home Equity Conversion Mortgages. Fairway Reverse Mortgage, a division of Fairway Independent Mortgage Corporation, proudly offers HECM, Reverse for Purchase, and Jumbo reverse mortgages.

A+ Rating From the Better Business Bureau · Available in 48 States and the District of Columbia · Free Reverse Mortgage Guide Provided · Offers Jumbo Reverse. 1. Homeowner With Sufficient Equity · Get better loan terms: ; 2. Homeowner Who Has Substantially Paid or Has Paid Off Their Mortgage · Grow your retirement income. A reverse mortgage is a powerful tool that allows seniors to access the equity in their homes without selling or making monthly mortgage payments. If you need a smaller amount of cash quickly, personal loans are the better solution compared to reverse mortgages that typically have a minimum loan amount and. See how Equitable Bank's reverse mortgage rates, advance options, and fees stack up next to the competition. Learn about our interest rates and prepayments. The HECM is the FHA's reverse mortgage program that enables you to withdraw a portion of your home's equity to use for home maintenance, repairs, or general. After hours of researching all of the reverse mortgage companies, we used our data-driven metrics to determine which are the best. If you need a smaller amount of cash quickly, personal loans are the better solution compared to reverse mortgages that typically have a minimum loan amount and. The only reverse mortgage insured by the U.S. Federal Government is called a Home Equity Conversion Mortgage (HECM), and is only available through an FHA-. Choose the best reverse mortgage for your needs among competing reverse mortgage companies by considering these factors. Home Equity Conversion Mortgages (HECMs). These are the most common type of reverse mortgage — you can use them for any purpose. They are federally-insured by. All Reverse Mortgage Inc., or ARLO, is based in Orange, California. They focus exclusively on reverse mortgages and are licensed to operate in 15 states. South River Mortgage is among the top rated reverse mortgage lenders in the US. If you're looking for knowledgable & seasoned reverse mortgage lenders to. best practices” for the reverse mortgage industry. Each lender is required to abide by these “best practices” and it is highly recommended that you utilize. The 6 Best Reverse Mortgage Companies. Offers FHA-Insured HECM Reverse Mortgage? Offers Other Reverse Mortgage Products? Maximum Payout*, States Available, BBB. Because there is a cap on the value of HECMs, proprietary reverse mortgages are more appropriate for higher-valued homes carrying small mortgages. These are. A reverse mortgage loan can be quite beneficial for the financial security of qualified seniors, ages 62 and over who have sufficient equity in their homes. We've compiled some of 's top-reviewed reverse mortgage lenders, based on customer evaluations published on downloadvideobokep.site Experience - CTC Mortgage is proud to be one of the leading reverse mortgage companies in Florida for over 10 years. · Pricing - As we offer some of the best.

How Much Is A 50 000 Bond

The maximum surety bond amount is not the same as your bond cost. For example, if you are required to secure a $50, surety bond, you will not have to pay. that if forfeiture is under M.C.R. 14, the bond can be used to pay court costs, but if the "Court" is defined in 50 App. U.S.C. § (5) as including. Use this table to find out how much the bond fee is: BOND. CHARGE. BOND. CHARGE. BOND. CHARGE. BOND. CHARGE. $ $ $23, $1, $50, $3, Chances are you will have to get a bail bond to get out of jail if you or your loved one has been arrested for any type of serious crime. if at least 50 pounds and less than pounds if pounds or more. 10, - Base bail is $50, Bail is subject to enhancement for aggravating. So, if the court rules your bond is $50,, the fee is $5, It's beneficial for an accused to be released from jail, as this allows them to attain legal. Calculate how much you can expect to pay to post bail for a friend or loved one. Military and union-member discounts available! If my bail is $,, how much should I pay? ; $20,, 10%, $2, ; $50,, 10%, $5, ; $,, 10%, $10, ; $,, 10%, $15, An easy equation would be any bond over $5, is 7% plus $ We take 35% of that down for payment plans. Another way to get this down minimum payment is by. The maximum surety bond amount is not the same as your bond cost. For example, if you are required to secure a $50, surety bond, you will not have to pay. that if forfeiture is under M.C.R. 14, the bond can be used to pay court costs, but if the "Court" is defined in 50 App. U.S.C. § (5) as including. Use this table to find out how much the bond fee is: BOND. CHARGE. BOND. CHARGE. BOND. CHARGE. BOND. CHARGE. $ $ $23, $1, $50, $3, Chances are you will have to get a bail bond to get out of jail if you or your loved one has been arrested for any type of serious crime. if at least 50 pounds and less than pounds if pounds or more. 10, - Base bail is $50, Bail is subject to enhancement for aggravating. So, if the court rules your bond is $50,, the fee is $5, It's beneficial for an accused to be released from jail, as this allows them to attain legal. Calculate how much you can expect to pay to post bail for a friend or loved one. Military and union-member discounts available! If my bail is $,, how much should I pay? ; $20,, 10%, $2, ; $50,, 10%, $5, ; $,, 10%, $10, ; $,, 10%, $15, An easy equation would be any bond over $5, is 7% plus $ We take 35% of that down for payment plans. Another way to get this down minimum payment is by.

This bail bond requires the defendant to pay the full amount of the bond or use some type of collateral for 90 of the bond total, and then have the bail. Use Our Bail Calculator to Find Out How Much Does a Bail Bond Cost? How does A fixed rate of $ $ 10% of set bail. $+. 7% of set bail +. Surety bonds are more common than cash bonds. As part of a surety bond, a judge ordering $50, requires you to provide $5, to a bondsman. The bondsman then. The bail amount for false imprisonment of an elder or dependent person is $50, How much is bail for assault upon a custodial officer (PC )? The bail. So if you owe $50,, you can pay $ to the bail bondsman, who gives $50, to the court. If you return for your court date, he gets his. Ventura Bail Schedule for Felony and Misdemeanor Offenses · Involuntary – $50, · Vehicular – $50, to $, depending on certain factors · Voluntary –. You pay the agent up to 10% of the bail amount so that if a defendant has bail set at $50,, you can buy or secure a bond for $ After paying the bond. Use Our Bail Calculator to Find Out How Much Does a Bail Bond Cost? How does A fixed rate of $ $ 10% of set bail. $+. 7% of set bail +. $50, Class F to I: The minimum punishment ranges from 3 to 59 months with a bail amount of $20, or below. How Does a Bail Bond Work? Once a judge sets. This bail premium, or bail fee, is 10 percent of the full bail amount. For example, if the court has set bail at $50,, then the bail premium charged is. Similarly, a $50, bond would cost between $–$5, and a $, bond would be around $2,–$50, Does It Cost to Apply for a Bond? No, the. How much does a $50, bond cost? · Excellent Credit: $ to $ per year. · Average Credit: $1, to $2, per year. · Bad Credit: $2, to $5, per year. Nevertheless, $20, and $50, are more typical bail amounts for less serious offenses. how much bail will be given because it depends on the offense. More serious violations such as DWIs and felonious acts like robbery have bail ranges from $1, to $50, If a criminal act is more threatening to the. class of charge in determining in which Court the case shall be filed. If the Defendant posts a cash bond, a 10% administrative fee not to exceed $50 will be. The formula to determine the maximum fees that a bail bond agent can charge for a bail bond is: $50, 10% of $3, + 8% of $7, + 6% of $40, A bond allows an arrested person (defendant) to be released from jail until his or her case is completed. A $ Death Benefit Fee is added to all bond. Your Alabama Notary Surety Bond Alabama law requires all Notaries to purchase and maintain a $50, Notary surety bond for the duration of their 4-year. How much does a $50, bond cost? · Excellent Credit: $ to $ per year. · Average Credit: $1, to $2, per year. · Bad Credit: $2, to $5, per year. A bail bond agent may accept collateral security in excess of $50, cash per bond, provided any amount over $50, cash is payable to the insurer in the.

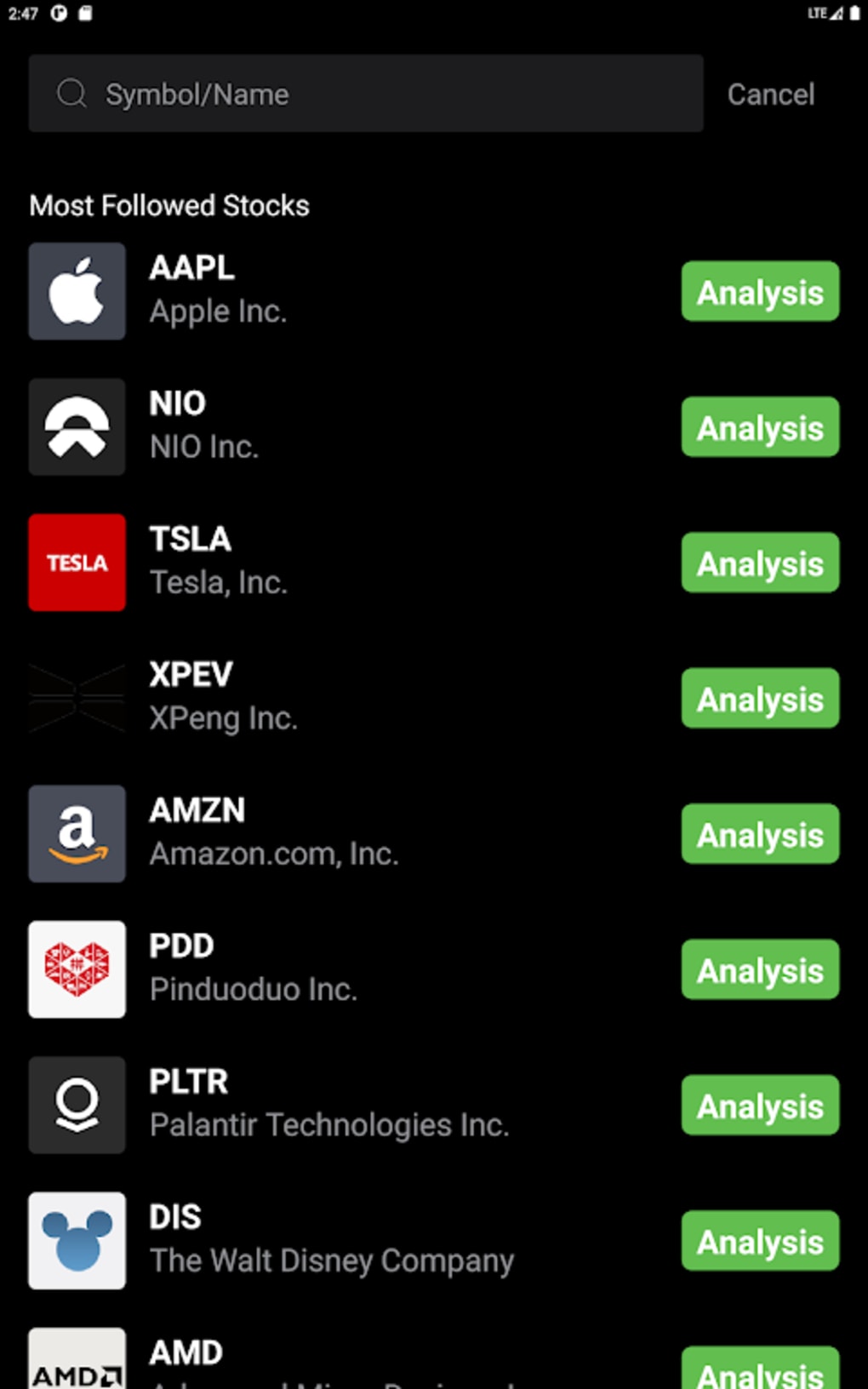

Stock Signal Screener

Using our free technical stock screener you can see results for the best stocks to buy based on indicators and end of day data updated after the market closes. Stock screener for investors and traders, financial visualizations Signal. None (all stocks), Top Gainers, Top Losers, New High, New Low, Most. Running a Saved Screener at a later date will always present a new list of results. Your Saved Screener will always start with the most current set of symbols. Stock screener for investors and traders, financial visualizations Signal. None (all stocks), Top Gainers, Top Losers, New High, New Low, Most. WaveTrend Signal Will Acc/Distr. Price Trend Stock Screener tool provides you with the ability to build criteria based on parametrizable indicators. WaveTrend Signal Will Acc/Distr. Price Trend Stock Screener tool provides you with the ability to build criteria based on parametrizable indicators. downloadvideobokep.site provides the opportunity to screen all the world's leading stock exchanges: Nasdaq, NYSE, OTC, TSX, TSXV, LSE, Euronext. You get an awesome screener, stock swing trades, long term stock trades, option trades, crypto trades, stock analysis all for bargain price. I have beat my. Create your own stock screener with over different screening criteria from Yahoo Finance. Using our free technical stock screener you can see results for the best stocks to buy based on indicators and end of day data updated after the market closes. Stock screener for investors and traders, financial visualizations Signal. None (all stocks), Top Gainers, Top Losers, New High, New Low, Most. Running a Saved Screener at a later date will always present a new list of results. Your Saved Screener will always start with the most current set of symbols. Stock screener for investors and traders, financial visualizations Signal. None (all stocks), Top Gainers, Top Losers, New High, New Low, Most. WaveTrend Signal Will Acc/Distr. Price Trend Stock Screener tool provides you with the ability to build criteria based on parametrizable indicators. WaveTrend Signal Will Acc/Distr. Price Trend Stock Screener tool provides you with the ability to build criteria based on parametrizable indicators. downloadvideobokep.site provides the opportunity to screen all the world's leading stock exchanges: Nasdaq, NYSE, OTC, TSX, TSXV, LSE, Euronext. You get an awesome screener, stock swing trades, long term stock trades, option trades, crypto trades, stock analysis all for bargain price. I have beat my. Create your own stock screener with over different screening criteria from Yahoo Finance.

Interactive user tool for selecting stock symbols based on ticker info, stock price, market activity, technical indicators, volume, and relevant dividend. Create a stock screen. Run queries on 10 years of Buy Signal. Get Email Updates. CMP. Stock Screener. Stock Screener by TradingView. Overview. 1-Month High. 1 Signal (12, 26). Market Capitalization. Momentum (10). Money Flow (14). Monthly. Buying for long-term. Stocks above 44 MVA in buy mode and Stocks below 44 MVA in sell mode. by Jagdish. results found: Showing page 1 of Industry. Stock screener for investors and traders, financial visualizations. Benzinga Pro's stock Scanner helps you easily scan for stocks with updates in real-time. Use filters like price, market cap, volume, float, relative volume. However recently most of those set of stocks have hit 52 week highs and are extremely overbought, so im looking to use a stock screener to find. Stock Screener App is Unique Intraday Screener and Trading Signal Strength generator based on Technical Analysis and Daily Range Breakout Patterns in the. Long Term % Buy Signals. This screener finds bullish stocks that have sustained a % Overall Buy Signal (the combination of all 13 technical. Stock screeners are tools that allow investors and traders to sort through thousands of individual securities to find those that fit their own methodologies. Description · 1. Analyze any stock, anywhere, anytime · 2. Find out ideal stock support and resistance level · 3. Spot stock right timing to place your set ups. Create custom screeners utilizing easy to build query-based screeners for both technical and fundamental metrics of any stock! Free stock screener for investors and traders. Use customizable AInvest screener to find stocks and winning strategies to fit your trading style. Use the Market Screener, on MarketWatch, to browse global stock markets performance for the latest trends, historical data and more. Screeners lets you choose from hundreds of data filters to discover Stocks, Mutual Funds, ETFs and more. A stock screener is an essential tool used by stock traders and investors to sift through thousands of stocks so they can find those that best meet their. The Fidelity Stock, Preferred Security, ETF/ETP and Closed End Fund Screeners (Screener(s)) are research tools provided to help self-directed investors evaluate. Including a review of the Tradingview stock screener, Forex signal screener, and the Cryptocurrency screener. You'll really be impressed with the number of. Use the Stock Screener to scan and filter stocks based on market cap, dividend yield, volume and analyst ratings and estimates. Create your own screener for. Buying for long-term. Stocks above 44 MVA in buy mode and Stocks below 44 MVA in sell mode. by Jagdish. results found: Showing page 1 of Industry.